Publicly available LEI data pool can be regarded as a global directory, which greatly enhances transparency in the global marketplace.

Enter the contact details of the person applying

| TYPE OF ENTITY | DOCUMENTS TO BE UPLOADED | |

|---|---|---|

| 1 | Private Limited Company/Public Limited Company/Limited Liability Partnerships or any company registered with Ministry of Corporate Affairs (MCA) | Certificate of Incorporation/ GST Certificate/ IEC Certificate |

| 2 | Trust | Trust Deed / Trust Registration Certificate / any other registration certificate issued by competent authority / PAN |

| 3 | Proprietorship | IEC Certificate/ GST Certificate/ Udyam Registration Certificate/ Shops and Establishment License / Proprietor's PAN |

| 4 | Partnership | Partnership Deed / PAN / GST Certificate / IEC Certificate |

| 5 | Bank not registered with MCA | Banking License Issued by RBI |

| 6 | Mutual Fund and Alternative Investment Fund | SEBI Registration Certificate / List of Custodian |

| 7 | Others | Registration Certificate / any other registration certificate issued by competent authority |

Note: We may ask for additional documents/information as the case may be.

MNS Credit is a Validation Agent for Legal Entity Identifier India Limited (LEIL), a Local Operating Unit (LOU) accredited by Global Legal Entity Identifier Foundation (GLEIF) Switzerland, the organisation that manages global LEI system (GLEIS) through LEI issuing entities, known as LOUs.

LEIL is the only LOU in India which is authorised by the Reserve Bank of India (RBI) under PSS Act of India.

MNS with a long standing in the field of authentication and verification of existence of Business Entities has more than two decades of experience and is acknowledged as a highly reliable partner by Financial Institutions for its Business Information Reports of various kinds.

Explaining importance and usage of LEI to prospective legal entities.

Explaining importance and usage of LEI to prospective legal entities.  Helping accelerate digital transformation, validation processes etc.

Helping accelerate digital transformation, validation processes etc.  Validating legal entity data for and before issuance of LEI to them.

Validating legal entity data for and before issuance of LEI to them. Streamlining LEI issuance process for legal entities and shorten onboarding time.

Streamlining LEI issuance process for legal entities and shorten onboarding time.

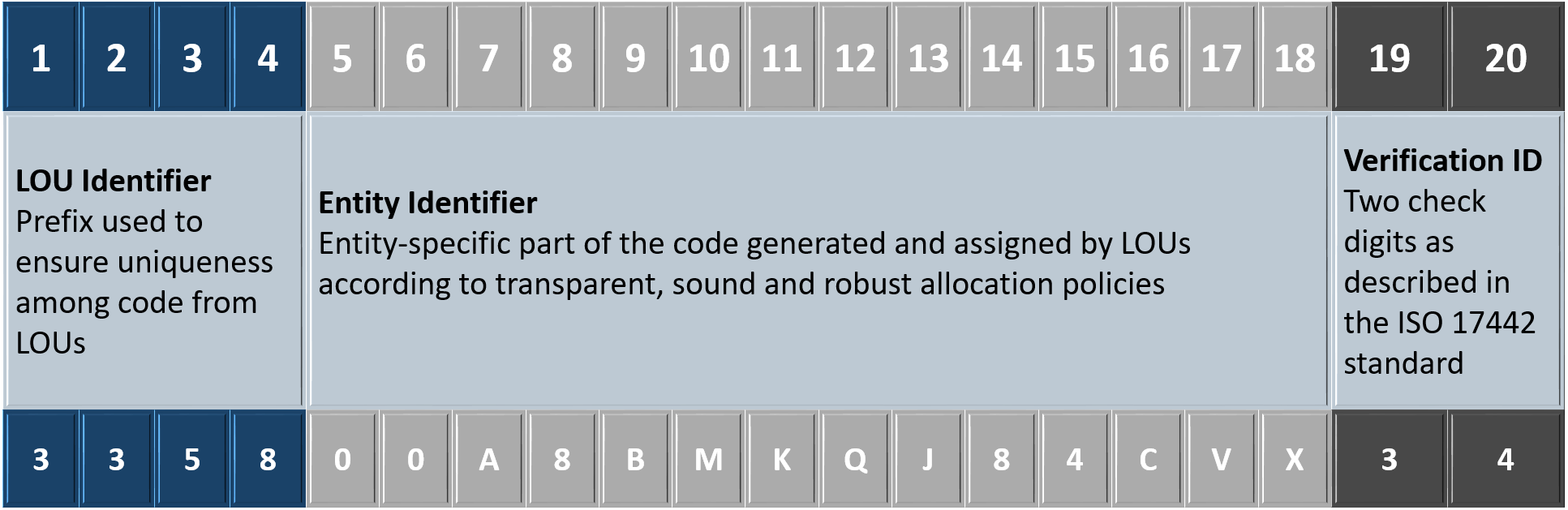

A 20-character, alpha-numeric code

A 20-character, alpha-numeric code Based on the ISO 17442 standard

Based on the ISO 17442 standard A proof of identity for a financial entity

A proof of identity for a financial entity Helps to abide by regulatory requirements and facilitate transaction reporting to Trade Repositories.

Helps to abide by regulatory requirements and facilitate transaction reporting to Trade Repositories. Connects to key reference information that enables clear and unique identification of legal entities participating in financial transactions.

Connects to key reference information that enables clear and unique identification of legal entities participating in financial transactions. Contains information about an entity’s ownership structure thus informs of ‘who is who’ and ‘who owns whom’.

Contains information about an entity’s ownership structure thus informs of ‘who is who’ and ‘who owns whom’.For Example: MNS Credit Management Group- LEI Number

The LEI is a 20-character alphanumeric code issued as per the ISO 17442:2012 standard, and the LEI code structure is as stated below:

Any legal entity who is a party to financial transactions may obtain an LEI certificate through LEI registration in India. These entities can be a company registered with MCA, partnership firm, sole proprietorship firm, a bank, a mutual fund, a trust, societies, etc. RBI has also introduced guidelines mandating LEI for electronic trading platforms to enhance transparency and compliance.

The Indian Regulators such as RBI, SEBI and IRDA etc. issue the notifications for the requirement of LEI code for different financial transactions.

Further, they have already issued some notifications in the past, given below for the requirement of LEI Number Registration:

LEI Code Mandates In India:

| Date | Asset Class / Market Participants | Particulars | Circular |

|---|---|---|---|

| 02-06-2017 | OTC derivatives markets | The Reserve Bank of India has mandated the implementation of the LEI system for all participants in the Over-the-Counter (OTC) markets for Rupee Interest Rate derivatives, foreign currency derivatives and credit derivatives | Download |

| 02-11-2017 | Large corporate borrowers | The Reserve Bank of India has mandated the phase-wise implementation of the LEI system for all borrowers of banks in India. Entities without an LEI code are not to be granted renewal/enhancement of credit facilities | Download |

| 29-11-2019 | Non-derivative markets | The Reserve Bank of India has mandated the phase-wise implementation of the LEI system for Non-derivative markets, including Government securities markets, money markets and non-derivative forex markets (cash, tom and spot transactions). | Download |

| 29-10-2019 | Eligible Foreign Entities | Securities and Board of India has mandated the LEI code for Eligible Foreign Entities (EFEs) in the commodity derivatives market | Download |

| 06-06-2020 | Insurers/Corporate borrowers | The Insurance Regulatory and Development Authority of India (IRDAI) has mandated the implementation of the LEI system for all insurers and their corporate borrowers. | Download |

| 05-01-2021 | RTGS/NEFT Transactions | The Reserve Bank of India has mandated the LEI Number for all payment transactions of value ₹50 crore and above undertaken by entities (non-individuals) for Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT). | Download |

| 10-12-2021 | Cross-Border Transactions | The Reserve Bank of India has mandated the LEI Number for cross-border transactions such as capital or current account transactions of ₹50 crore and above. The timeline to obtain an LEI Number is October 1, 2022. | Download |

| 21-03-2022 | Legal Entity Identifier (LEI) for Borrowers | The Reserve Bank of India has mandated the phase-wise implementation of the LEI system for borrowers of banks and FIs in India greater than ₹5 crores. Entities without an LEI code are not to be granted renewal/enhancement of credit facilities. | Download |

| 03-05-2023 | Non-convertible securities, securitised debt instruments and security receipts | Securities and Board of India has mandated LEI code for issuers transacting in listed non-convertible securities and issuers transacting in listed securitised debt instruments and security receipts. The timeline to obtain LEI Number is September 1, 2023. | Download |

| 28-07-2023 | Foreign Portfolio Investors (FPIs) | Securities and Board of India has mandated reporting of LEI code for Foreign Portfolio Investors (FPIs) to depositories (DPs) in India. The timeline to report the LEI Number to DPs is January 23, 2024. | Download |

You may please call us on +91-11-49455102 / +91-9717859833 / +91-7718007384 or click here to enable us to contact to assist you in the LEI registration in India and document submission process.

Following the financial crisis, G20, the Financial Stability Board, and many regulators around the world aimed to create transparency in the derivatives markets through the Legal Entity Identifier (LEI) initiative. Primarily, the LEI certificate is used to identify the parties that participate in financial transactions around the world. However, it also helps in identifying the ownership structures of legal entities engaged in such transactions to better understand the systemic risks arising out of their linkages.

Publicly available LEI data pool can be regarded as a global directory, which greatly enhances transparency in the global marketplace.

Supports higher quality and accuracy of financial data overall

Supports entity identification across financial markets and beyond.